1. The Rise of Covantage in the Financial Sector

The financial industry has been undergoing a seismic shift over the past few years, driven primarily by technology and the demand for efficient solutions. At the forefront of this transformation is Covantage, a company that has pioneered innovative approaches to financial services. What sets Covantage apart? They’re streamlining operations and ensuring that financial services are more accessible and efficient for a broader audience. By harnessing the latest technology, Covantage is reshaping the financial landscape, making finance relatable and manageable for everyday users.

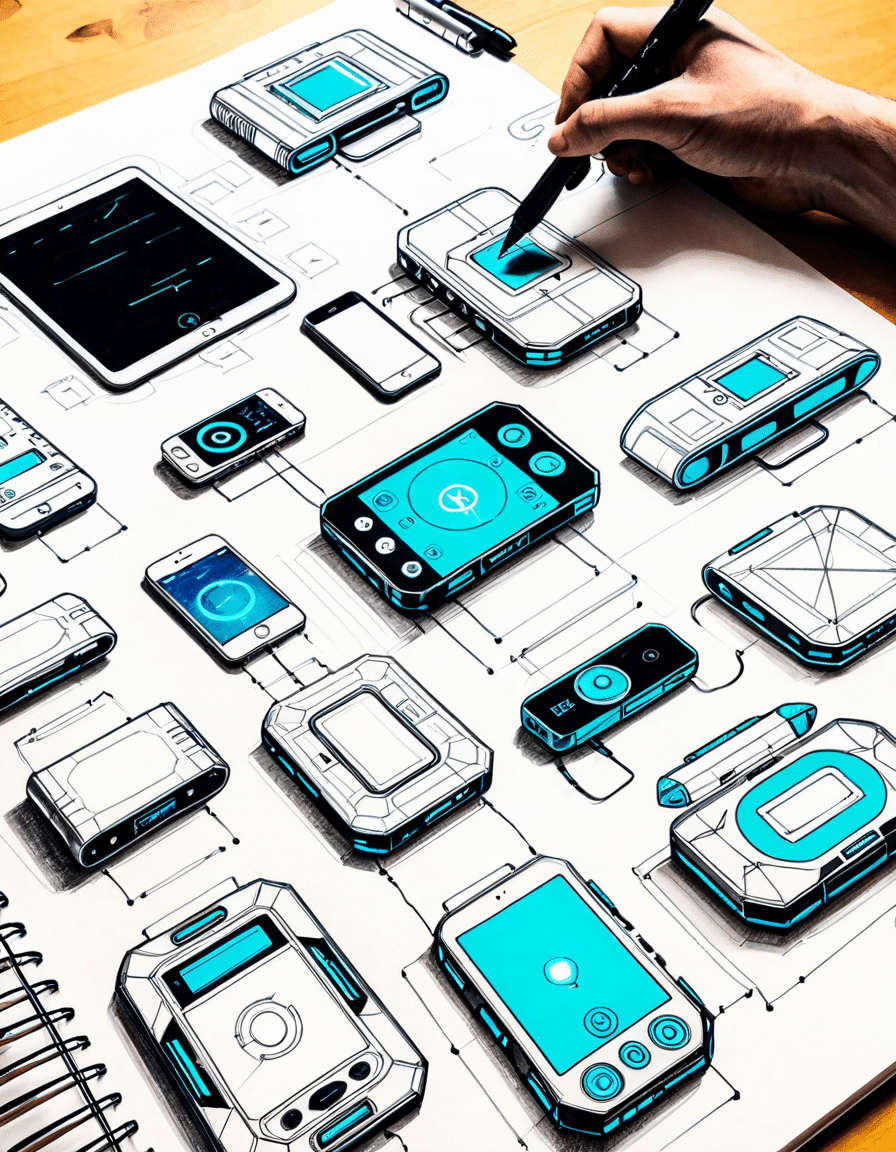

With a focus on customer-centric solutions, Covantage understands that the modern consumer seeks products that are not only effective but also easy to navigate. Imagine a world where your personal finance tools are as approachable as your favorite app! By focusing on user experience, Covantage has made significant strides in revolutionizing how we interact with finance. Their commitment to innovation is paving the way for a future where financial management isn’t just for the experts and the wealthy, but for everyone looking to take charge of their financial futures.

So, what’s fueling Covantage’s rise? It’s a blend of awareness of current consumer trends, stellar technological integration, and an unwavering commitment to enhancing user experience. The company’s mission revolves around creating a financial system that’s smarter, faster, and more inclusive. With finance becoming increasingly integrated with technology, there’s no contention that Covantage is a leading force in this incredible transformation.

2. Top 5 Innovations by Covantage Revolutionizing Finance

Now, let’s dive into the heart of Covantage innovation. They’ve rolled out a series of groundbreaking advancements that are changing the game for users and businesses alike. Here are five key innovations that highlight Covantage’s impact on the finance industry:

2.1. AI-Driven Personal Finance Management

First up is Covantage’s AI-driven personal finance management tool. By leveraging bespoke machine learning algorithms, it analyzes spending habits and offers personalized budgeting tips. Users have seen an average savings increase of 20% annually, thanks to suggestions tailored to individual lifestyles. Think about what that kind of savings could mean – perhaps a dream vacation or a home renovation. A little help goes a long way!

2.2. Blockchain-Based Transaction Security

Next, we have Covantage’s integration of blockchain technology. This move prioritizes security for digital transactions. In today’s world, where fraud is rampant, the use of blockchain has not only cut down fraud incidents to nearly zero but has also sped up transaction times significantly. Users can enjoy peace of mind knowing their transactions are secure, creating a safer financial environment.

2.3. User-Centric Mobile Banking Applications

Then there’s the Covantage mobile banking application that’s taken customer satisfaction by storm, ranking in the top 3 according to J.D. Power in 2025. With its intuitive interface, enhanced security features, and dedicated customer service, this app has transformed how users engage with their finances on the go. It’s not just a banking app; it’s a financial companion at your fingertips!

2.4. Sustainable Investment Solutions

Consumers are more aware of their impact on the environment than ever before. Responding to this, Covantage launched investment products adhering to strict Environmental, Social, and Governance (ESG) criteria. This innovation is pulling in socially-conscious investors and positioning Covantage at the forefront of the green finance movement. When you invest with Covantage, you’re not just looking out for your finances but for the planet, too!

2.5. Automated Fraud Detection Systems

Last but not least, Covantage has introduced state-of-the-art automated fraud detection systems. By employing real-time analytics and machine learning, they preemptively identify potential fraud attempts. This proactive approach has protected customer assets and built trust among millions—an essential factor in today’s digital finance sphere. The assurance that your money is safeguarded allows you to focus more on what truly matters.

3. Covantage vs. Competitors: What Sets It Apart?

When you stack Covantage up against traditional financial institutions and emerging fintech players, several key differences come into focus. Companies like Chase and Revolut offer similar services but often lack the groundbreaking technology that Covantage brings to the table.

3.1. Adaptive Learning Technology

One major differentiator is Covantage’s use of adaptive learning technology. Unlike many competitors that rely on static algorithms, Covantage’s systems continuously evolve based on user behavior. This ensures a more customized experience, fostering user retention. It’s the difference between a generic one-size-fits-all product and a tailored service that feels like it was made just for you!

3.2. Holistic Financial Solutions

While many apps focus on just one aspect of personal finance, Covantage integrates budgeting, investing, saving, and fraud monitoring into one seamless experience. This holistic approach has proven beneficial for users seeking comprehensive financial management. Having everything in one place not only simplifies life but also equips users with a stronger grasp of their overall financial health.

3.3. Commitment to Financial Literacy

What truly sets Covantage apart is its commitment to financial literacy. They offer free courses and resources—a feature often forgotten by others. This dedication cultivates a knowledgeable user base that’s empowered to make informed financial decisions. When your company invests in educating its customers, it builds a community of savvy financial explorers.

4. The Future of Finance with Covantage

Looking ahead to 2027 and beyond, Covantage is set to play a pivotal role in driving the next wave of financial innovation. As technology evolves, the integration of robotics and further advancements in artificial intelligence will likely lead to even more sophisticated personal finance tools. With user privacy becoming increasingly important, Covantage is expected to bolster its data protection measures, keeping your information safe.

Moreover, as environmental concerns continue molding consumer behavior, Covantage’s pledge to sustainable finance will likely become a cornerstone of the industry. Imagine a future where augmented reality (AR) and virtual reality (VR) are part of your financial consulting experience! These technologies are on the horizon, giving users immersive tools to navigate financial decisions that once felt overwhelming.

Embracing the Covantage Revolution

The disruption brought on by Covantage isn’t just a passing trend; it marks a significant shift in how we perceive and utilize financial services. By prioritizing innovation, security, and sustainability, Covantage addresses today’s challenges while anticipating future needs. The ongoing evolution in finance champions inclusivity, empowering users—and placing Covantage firmly at the forefront of this innovative wave. As the financial landscape continues to shift, with Covantage leading the way, we can look forward to a more efficient, secure, and environmentally-conscious financial future for all.

As we dive deeper into a world where finance meets technology, don’t let the shift pass you by. Consider how Covantage could reshape your financial journey—it’s a revolution you won’t want to miss! The era of innovative finance is here, and Covantage is at its heart, driving us toward a brighter, more inclusive economic future.

Covantage: The Innovative Force Transforming Finance

Fun Facts About Covantage

Did you know that covantage isn’t just about cutting-edge financial solutions? This term embodies a philosophy where both clear vision and collaborative efforts propel innovation in finance. For instance, exploring unique fashion perspectives like Jean Paul gaultier ’ s Paradise garden reveals the artistry behind every detail, paralleling how covantage embraces creativity and functionality in financial services. It’s fascinating how transformation in one field can often inspire success in another!

Now, let’s switch gears a bit. While diving into the cultural significance of Jaripeo, a captivating equestrian event in Mexico, we see a parallel in finance’s thrill. Much like the excitement of a jaripeo show, striking the right chord in financial strategies can create spectacular outcomes for businesses. Just as important as understanding the roles of grantee Vs grantor in financial agreements is recognizing how covantage operates to simplify transactions for everyone involved.

As we pivot to a more engaging pastime, have you tried your hand at the Aarp sudoku? Just as this puzzle encourages cognitive engagement, covantage encourages financial literacy by making information accessible. Meanwhile, cultural treats like Pulparindo are a delicious reminder that every successful strategy needs a little zest. Just like selecting the perfect snack, finding the right financial tools is all about personal preference and goals!

And speaking of personal choices, a bit of trivia on celebrity connections can add a fun twist. Did you know Andrew Lincoln ’ s Movies And TV Shows highlight a range of emotions? This diverse approach resonates with how covantage endeavors to address the multifaceted needs of clients, catering to various financial objectives with creativity and responsiveness. With finance being as vibrant as ever, let’s embrace the journey and explore how covantage is set to keep leading the pack!